ny highway use tax form mailing address

This form replaces Forms IFTA-1 and IFTA-9. With full payment and that payment is not drawn from an international financial institution.

Florida Form 2290 Heavy Highway Vehicle Use Tax Return

If you do youll more than likely need to obtain a Highway Use Tax HUT sticker.

. Registration includes paying your tax and then receiving your decals that need to be placed on your vehicle. Harriman Campus Albany NY 12227-0163 Phone. Highway Use Tax ReturnMT-903.

For forms and publications call. Paid preparers ID number Paid preparers mailing address For office use only Mail to. In order to determine the taxable gross weight of your vehicle add.

The guidelines below will help you create an signature for signing NY highway use tax form 2011 in Chrome. 20 rows Highway usefuel use tax IFTA The Tax Department recently received. Department of the Treasury.

NYS Taxation and Finance Department. New Businesses will report Highway Use Tax Qarterly. New York State Highway Use Tax TMT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway.

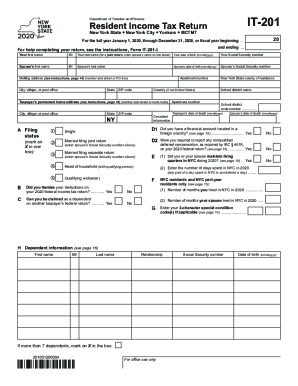

Form DTF-406 Claim for Highway Use Tax HUT Refund. If you ARE including a payment check or money order mail your return including Form IT-201-V to. I hereby acknowledge and agree that after the charges are authorized a DOT Operating Authority agent is assigned in 15 minutes to run the order.

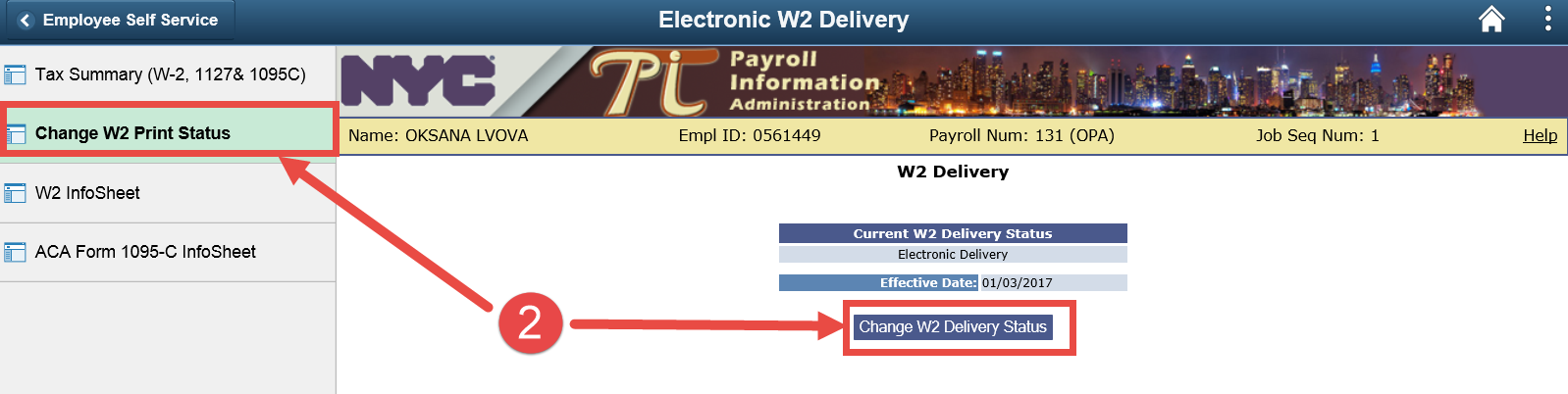

This sticker is obtained by applying to the New York State Department of Taxation and Finance to receive your registration. Any registration application including Forms TMT-1 TMT-39 and TMT-334 You also cant use HUT Web File to add vehicles onto or to cancel vehicles off of your highway use tax account. Highway use tax schedule totals First complete Schedule 1 or Schedule 2 or both on back page and then enter final totals in boxes 1a and 1b.

You must use One Stop Credentialing and Registration OSCAR to complete those tasks. Name Number and street or PO box City state ZIP code. For questions please call us at 202 851-5700.

Form MT-903 Highway Use Tax Return Revised 122 90300101220094 Department of Taxation and Finance Highway Use Tax ReturnMT-903 122 Legal name Mailing address Number and street or PO Box City State ZIP. With the collaboration between signNow and Chrome easily find its extension in the Web Store and use it to design NY highway use tax form 2011 right in your browser. Crane mail household goods etc 93115194.

Form 2290 Highway Use Tax Highway use tax and Heavy vehicle use tax can be used interchangeably. The previous address was. Find the extension in the Web Store and push Add.

The TOTAL COST includes all Federal State and Local Government fees. If no highway use tax is due for this period mark an X in one of the boxes below or enter 0 on line 3. You can only access this application through your Online Services account.

All miles reported by another leased motor vehicles All motor vehicles are exempt example. Final return Amended return Mark an Xin the applicable box. If you elect to use the unloaded weight method to file your returns a certificate is required for any truck with an unloaded weight over 8000 pounds and any tractor with an unloaded weight over 4000 pounds.

The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you. NYS Taxation and Finance Department HUTIFTA Application Deposit Unit WA. Without payment due or if payment is made through EFTPS or by creditdebit card.

Form MT-903 Highway Use Tax Return Revised 122. If additional charges are going to be authorized a new form will have to be completed. For more information contact.

This tax represents the required annual fee that you must pay if you operate vehicles with a registered gross weight equal or exceeding 55000 pounds on public highways. 90300101220094 Department of Taxation and Finance. STATE PROCESSING CENTER 575 BOICES LANE KINGSTON NY 12401-1083.

To change only your address use Form DTF-96Report of Address Change for Business Tax Accounts. If you need a form see Need help. In the instructions or visit our Web site at wwwtaxnygov or call 518 457-5431.

Mail Form 2290 to. 122 Legal name Mailing address Number and street or PO Box City State ZIP code. New York City forms.

HUTIFTA Application Deposit Unit. NYS TAX DEPARTMENT RPC - HUT PO BOX 15166 ALBANY NY 12212-5166 MT-903-MN 1007 Please make a copy for your records. The PO Box addresses above became effective June 1 2014.

The NY HUT Tax is required to be filed every quarter.

Vehicle Sales Tax Deduction H R Block

Chenango County Department Of Motor Vehicles

Certificate Of Authority Ny Fill Out And Sign Printable Inside New Certificate Of Authorizatio Certificate Authority Printable Signs Free Certificate Templates

New York Tax Attorney Tax Attorney New York Tenenbaum Law P C

Town Of Manchester Town Of Manchester New York

Town Of Queensbury Highway Department

Monroe County Ny County Executive

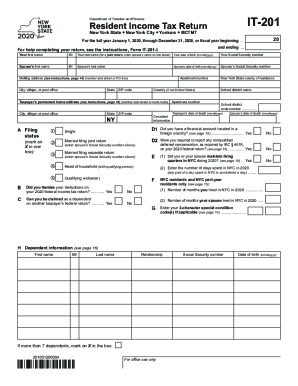

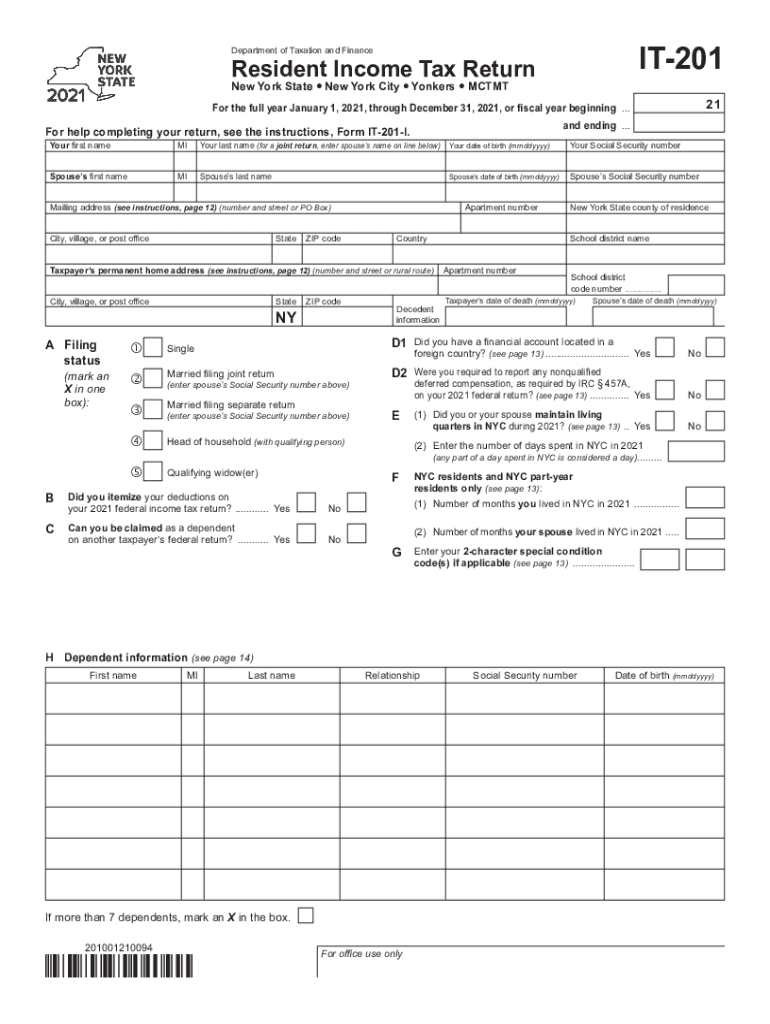

2021 Form Ny Dtf It 201 Fill Online Printable Fillable Blank Pdffiller

Welcome To Jefferson County New York Land Records

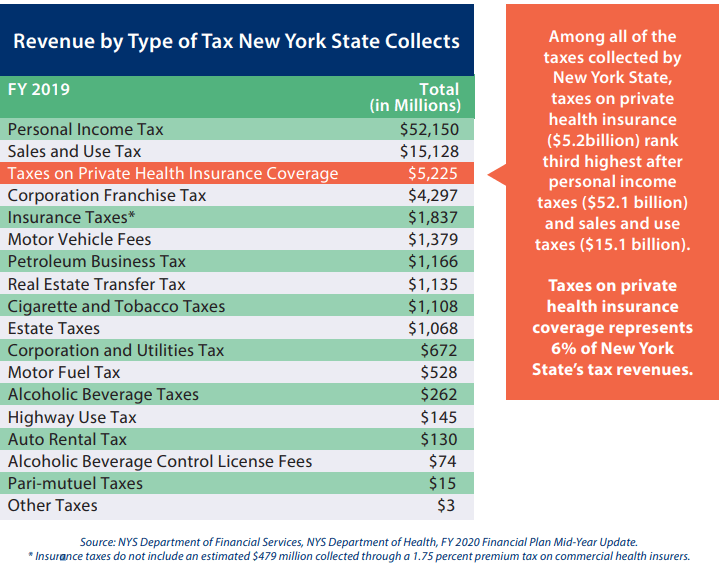

New York S Hidden Taxes Are Driving Up The Cost Of Coverage Nyscop New York State Conference Of Bluecross Blueshield Plans

2021 Form Ny Dtf It 201 Fill Online Printable Fillable Blank Pdffiller